Financial performance

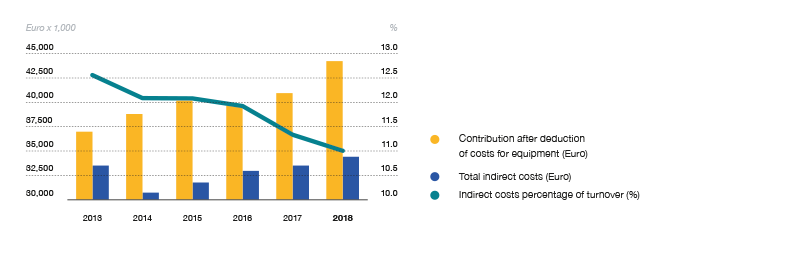

In 2018, Vos Logistics recorded turnover totaling 313.5 million euros (2017: 289.9 million euros), an increase of 8%. Adjusted for higher diesel prices, acquisition of Joosten and Gehlen Schols in 2018, and divestment of Zozaya in 2017, group turnover increased by 6% on the previous year. Earnings before taxes and interest rose by 25% to 10.1 million euros (3.2% margin). Excluding the impact of higher diesel prices, transition-related restructuring costs, and some other incidental items from the result, the EBIT margin would have reached 3.6%. Virtually all business lines saw turnover and EBIT rise. The rise in EBIT stems mainly from volume increases in combination with modest improvements in quality of revenues. In the course of 2017 and 2018, we were able to pass on earlier absorbed cost increases, relating mainly to labor, through our rates. Indirect costs in relation to turnover continued their downward trend, driven mainly by the transition process of our international transport activities as well the launch of lean initiatives. Interest costs were down 40%, mainly as a result of repayment of the mezzanine loan in 2017. As a result of higher EBIT and lower interest charges, net profit jumped 90% on the previous year.

Kontakt

Kontakt